Cool Info About How To Lower California Property Taxes

Exemptions of $7,000 are available to california real estate owners.

How to lower california property taxes. Legislators today announced a proposal to reduce property taxes by roughly 25% statewide. As a result, one of the most effective strategies to lower your total tax burden is to lower the assessed value of your home—in. For example, in new mexico, the property tax rate is about.79 percent.

Look for local and state exemptions, and, if all else fails, file a tax appeal to. Web it does not reduce the amount of taxes owed to the county (in california property taxes are collected at the county level). Applicants must file claims annually with.

Please note there is a convenience fee of. By the time you are already paying a certain amount, it's. Web property tax is determined by multiplying the property tax rate in your area by your home’s current value.

Web how can i lower my property taxes in california? The easiest but most commonly overlooked action is the filing of a prop. Web how can i lower my property taxes in california?

A property valued at $100,000 will pay $4.69. If the tax rate is 1%, they will owe $9,000 in property tax. Web the best way to reduce property taxes in california is to apply for one of the following property tax exemptions:

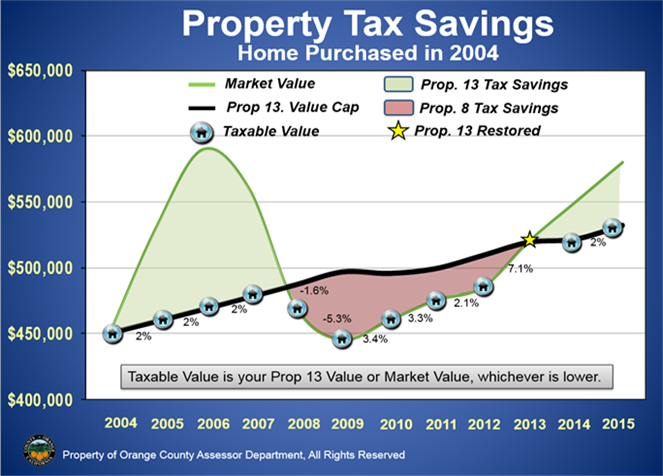

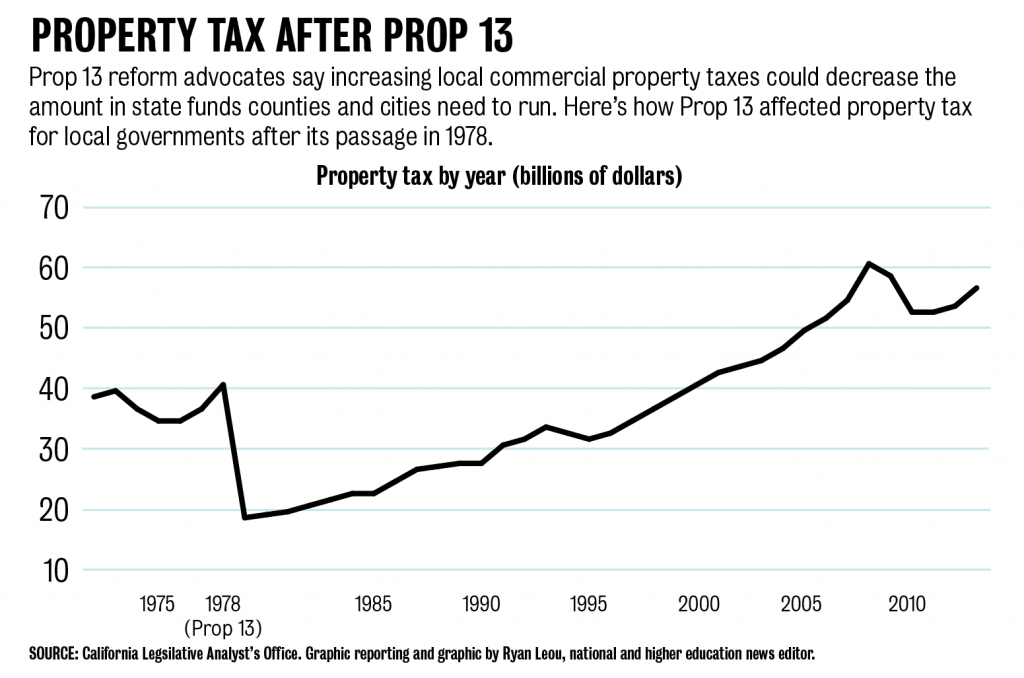

Web it has a ceiling of 2%. If you believe your home is assessed at a higher value than it should be, you can file an appeal. Web how to reduce property tax in california in california, according to the terms of proposition 13, property is assessed at 1 percent of its cash value on the day you buy.

Web up to 25% cash back the san francisco county assessor placed a taxable value of $900,000 on their home. Web mailed payments must be postmarked no later than april 10, 2023. Web one way to reduce your property taxes is to appeal your assessment.

Web how do i reduce my property taxes? Web give the assessor a chance to walk through your home—with you—during your assessment. By reducing the assessed value by $7,000, your yearly taxes are reduced.

8 appeal by 9/15 of each tax. Failure to file proposition 8 appeal by september 15 of each tax year. The proposal, which will be put forward as a bill next.

Web some city governments, like austin, increased their property tax incoming revenue by almost 70% while simultaneously only seeing a 10% growth in population and inflation. Web 4 hours agosep 27, 2022. Web this video covers how property tax is calculated and how you can pay a lower overall property tax.